If art collectors or artists do nothing during their lifetime, their heirs are likely to be subject to confiscatory inheritance taxes (see below – indirect taxes).

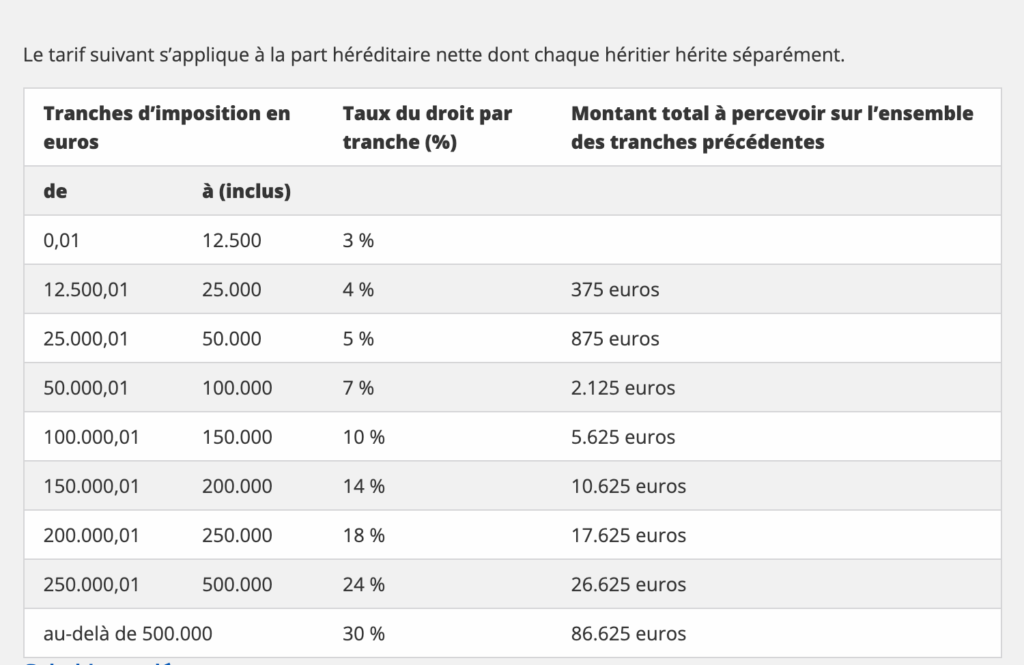

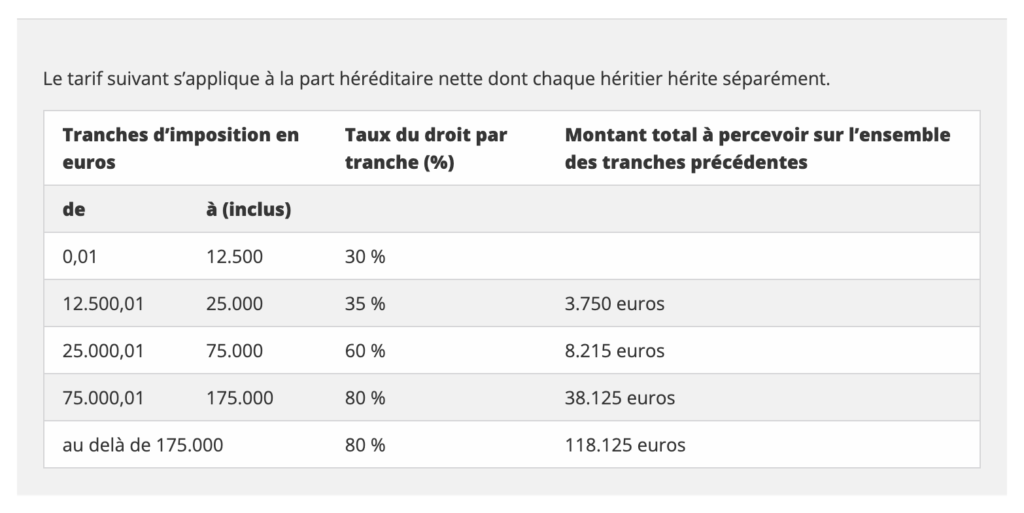

Different rates are applicable for inheritance tax in the Walloon Region/Brussels Capital Region. The rates vary according to:

- your relationship to the deceased ;

- the importance of the estate.

those “between other people” are clearly confiscatory:

The collection is thus at risk of being divided, sold or dispersed… or used to pay the inheritance tax since according to Article 83/3 of the Code of inheritance tax – Brussels-Capital and Walloon Region “Any heir, legatee or donee may, if he has the civil capacity required for this purpose, request the payment of all or part of the duties, payable in respect of an estate, by means of the dation in payment of works of art, which, on the advice of the special commission referred to in Article 834, are recognized by the Minister of Finance as belonging to the movable cultural heritage of the country or as being of international renown..

The collection is thus at risk of being divided, sold or dispersed… or used to pay the inheritance tax since according to Article 83/3 of the Code of inheritance tax – Brussels-Capital and Walloon Region “Any heir, legatee or donee may, if he has the civil capacity required for this purpose, request the payment of all or part of the duties, payable in respect of an estate, by means of the dation in payment of works of art, which, on the advice of the special commission referred to in Article 834, are recognized by the Minister of Finance as belonging to the movable cultural heritage of the country or as being of international renown..

In order to be offered in payment, the works of art must belong in their entirety to the estate or be owned in their entirety on the day of death by the deceased and/or his or her surviving spouse or heirs, legatees or donees.

This exceptional method of payment is subject to the formal acceptance of the offer by the Minister of Finance.”

Read: The incredible saga of the Janssen dation and Dation Janssen: and regionalization?

In addition, some owners of works of art wish to ensure, during their lifetime or after their death, an accessibility of their collection to the public via temporary exhibitions, joining one or several museums in Belgium or abroad or even the creation of a permanent museum.

Legal persons (whether or not they are merchants) have the advantage that they never “die” and can therefore (as a rule) be constituted for an indefinite period of time.

“The death of a natural person always leads to the payment of inheritance tax (in principle and subject to the existence of taxable assets).

The following clarification should be made here: if inheritance tax is assessed on the value of everything that is received in the estate of a natural person living in the kingdom, it could theoretically be argued that such tax is not due if the works of art belong to a legal person.

Indeed, if the works of art belong to a legal person (non-profit association, public utility establishment, private or public utility foundation (see the law of May 2, 2002 on non-profit associations, international non-profit associations and foundations, M.B., October 18, 2002, effective July 1, 2003), commercial company, etc.) and no longer to a natural person, no inheritance tax will ever be due again, because a legal person does not “die”. The death of one of its founders, shareholders, partners, directors or managers has no direct impact on the ownership of the assets that are part of the patrimony of this legal entity. No tax consequences will be attached to the death of any of these individuals.” François Derème – Inheritance and Registration Rights – Heritage and Works of Art – Selected Issues – 1st edition 2016 – Larcier – P. 371.

Surviving thus to the founders, and to any other actor (member, administrator, delegate to the daily management, employee or executive, volunteer,…), their patrimony escapes the inheritance taxes.

Only one (light) annual tax, the annual tax on NPOs, also known as the patrimonial tax, is a tax to compensate for the inheritance tax which, in the case of a legal entity, cannot be claimed. Besides NPOs, the tax also applies to private foundations and international NPOs.

The death of one of the shareholders of a company owning works of art has no direct impact on the ownership of the assets that are part of the patrimony of this legal entity, the heirs or legatees of this deceased shareholder will have to declare the company’s shares that will be in the estate of the latter. These assets will be liable to inheritance tax like any other movable asset of the estate. It will no longer be the works of art as such that will have to be declared, evaluated and taxed, but the shares of the company owning these works of art (no taxation of the assets contributed to the legal entity). This remark is not applicable when the works of art belong to an association or a foundation.

Various non-profit legal entities can thus be used to house a collection of works of art in order to maintain its unity, ensure its management, and even guarantee its intergenerational transmission and durability.