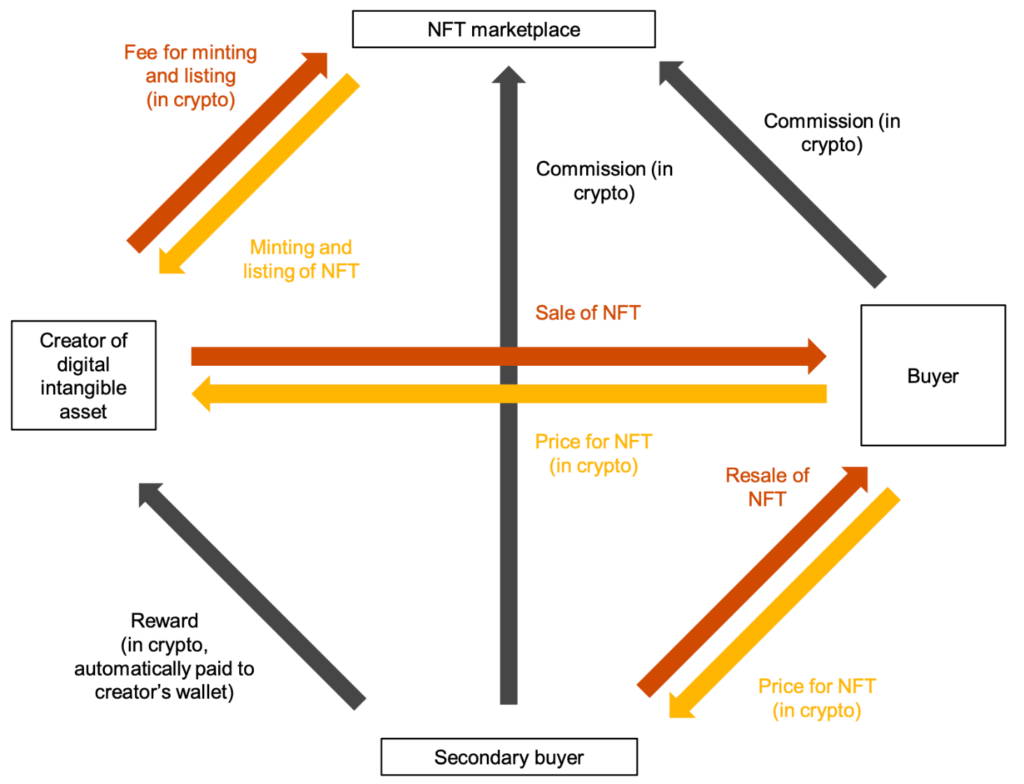

There are many parties, transactions, and times of impositioninNFT transactions:

Source: Non-Fungible Tokens (NFTs) : Legal, tax & accounting considerations you need to know.

A distinction will be made between :

- The taxation of the creator of NFTs who is in rule the seller (but not necessarily): to personal or corporate income tax – we refer to him below asCREATOR CONTRIBUTOR or 1st CONTRIBUTOR; and

- The taxation of the platform where the NFTs are exchanged – hereafter referred to as the PLATFORM CONTRIBUTOR or 2nd CONTRIBUTOR; and

- The taxation of the buyer of NFT upon resale to other buyers and likewise for each successive buyer/reseller – we refer to him hereafter as (RE)SELLER or 3rd SELLER.

The distinctions to be made by type of taxpayer at each stage of our tax review are shown in a BLUE box.

In SECTION 3, we provide a SUMMARY TABLEof the taxation of each taxpayer (1, 2 and 3).

We hope to be able to answer the question: what is the point of view of the Belgian tax administration?

Answering this question means applying, and sometimes adapting, the existing rules that have made Belgium an internationally renowned jurisdiction for the art market.

In order to guarantee a maximum of legal security in these complex and still mostly unregulated matters, we have decided to strictly apply the 6 Checks or 6 C’s method.

In particular, we have taken care to apply the 5th criterion as much as possible: “Check 5 When this option is possible in the situation in question, we question, on an anonymous basis of course, the “gendarme”, i.e. the control authority. The FSMA, the NSSO, the tax authorities, the commercial investigation department, an auditor or a public prosecutor, …”.

We thus refer as much as possible to the existing instructions of the tax authorities based on a long and uninterrupted tradition of a favorable regime for art in Belgium. We adapt them to the new situations created by the NFT if necessary, but always in accordance with an equation to which we always refer: NFT = ART = TAXATION AS WORKS OF ART.

We thus follow the legal syllogism:

- NFTs are a modern, digital form of art; and

- The tax regime for art is well known and favorable in Belgium; and

- NFTs benefit from this favorable tax regime.

We refer the reader to the many articles already published on the subject of cryptocurrency taxation on our site Thierry Lauwers. Finally, we also apply an original method called the 3 Q’s and O’s to answer any tax question:

“The method of 3 Q’s + 1 O Without further ado, here are the 4 questions or the 3 Q’s and the O: 1. Where (in the world) do I pay my taxes? 2. Which Direct Tax(s) do I pay? 3. What income(s) do I receive from the 4 Personal Income Taxable Income? 4. Who bears the expenses/What are the deductible expenses? ”

Do you have to declare profits on your bitcoins?

Throughout this article, we share TIPS (“tips”) related to CHOICES you can make that have important tax consequences. They are visually framed and written in PINK.