Non-Fungible Tokens (NFTs) are TAXED as WORKS OF ART in BELGIUM

By Thierry Lauwers & Christophe Boeraeve, tax lawyers

“People don’t understand NFTs, Metaverse, and crypto today the same way they didn’t understand online shopping in the 1995”.

― Anuj Jasani

NFTs are changing the world of visual arts, creative content and intellectual property in a profound and sudden way. From the first works of art in the caves of the Magdalenian period (from 17 000 to 10 000 BC) to the contemporary period, painters or drawers always used physical tools (brushes, palettes, markers,…) and different material supports (a sheet of paper, a canvas, a wall,…).

In the same way that crypto-currencies disrupt financial markets, by reducing intermediaries, NFTs transfer the value of works from intermediaries to creators.

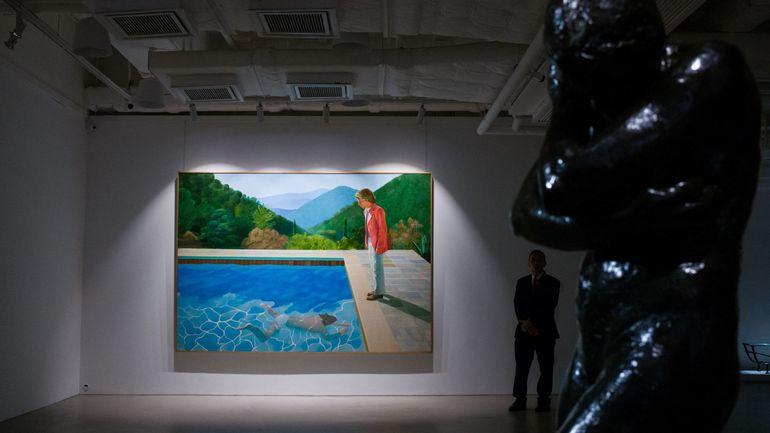

Before being dethroned by Koons’ Rabbit, British painter David Hockney’s “Portrait of an Artist (Pool with two figures)” sold for $90.3 million in November 2018 at Christie’s in New York.

David Hockney, who sold his painting for 20,000 dollars shortly after painting it, will get nothing from this sale…

In this large-format canvas, an elegant man stands by the pool and looks pensively at another swimming underwater in his direction, against the backdrop of an idyllic landscape of trees and mountains.

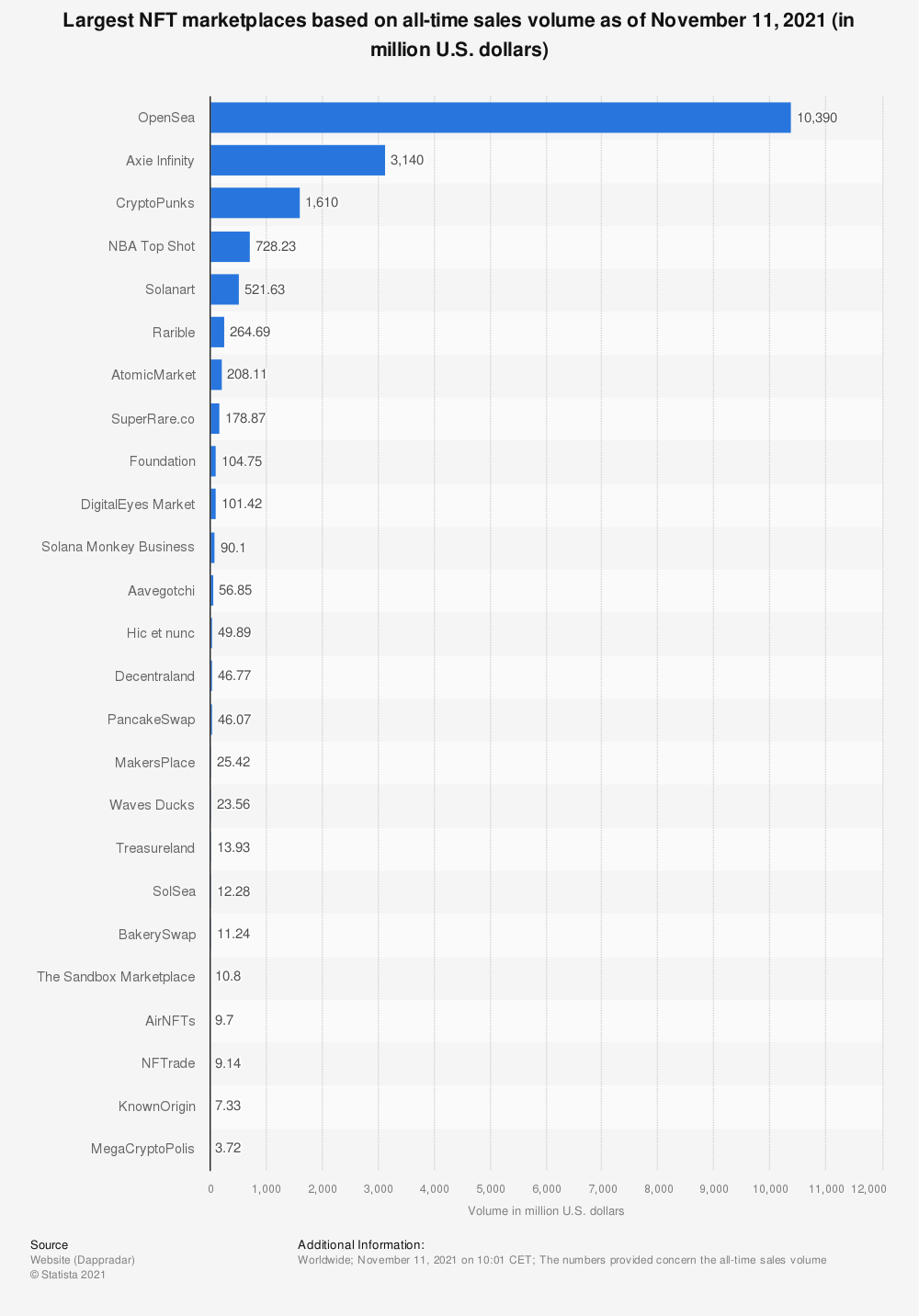

With NFTs, the artist is no longer deprived of capital gains from the successive sales of his works. Since the NFT is uniquely identified and unfalsifiable thanks to blockchain technology, the royalties can be traced and paid indefinitely to the artist. Thus, when an artistic work is used for commercial purposes, the artist can continue to receive income, which revolutionizes the world of art and intellectual property… And as NFTs are digital, they can be exchanged in an instant across the world via dedicated platforms (OpenSea, Async Art, Foundation, MakersPlace, SuperRare, Nifty Gateway, hic et nunc and the latest, the first Belgian platform: Open Your Art – OYA).

What is the legal status of Non-Fungible Tokens (NFTs)? Fongibles (JNFs)? This is a matter of debate. In Belgium, there is no law or regulation that specifically addresses the subject of crypto-currencies (although some rules apply for certain service providers since May 1st, 2022).

The tax concern of the investor acting within the framework of the management of its inheritance will arise primarily at the time of the resale of its good. Will the eventual capital gain be subject to taxation? What are the differences between an individual and a company? Or via a private foundation or an A(I)SBL?

We are of the opinion that digital versions of works of art benefit from the same favorable tax regime that has long been applicable in Belgium and that makes it attractive both in Belgium and abroad (and in particular the absence of the principle of taxation of capital gains).

The NFTs being by definition NON FUNGIBLE and thus UNIQUE, they can satisfy the conditions of the protection of the works of art or the regime of the “royalties”.

But before exploring the fascinating world of art,three questionsnaturally arise: